As the New Year begins, the challenges surrounding lead-times within the electronic component market look set to continue for some time to come.

As the New Year begins, the challenges surrounding lead-times within the electronic component market look set to continue for some time to come.

For Original Equipment Manufacturers (OEMS) there will be the continued need to make adjustments to the design, and the choice of components, for their printed circuit board assemblies (PCBAs).

And for those OEMs working with Electronics Manufacturing Services (EMS) providers, the importance of maintaining regular communication and continuing to share forecast information will remain paramount.

In this blog post we summarise the latest news on the condition of the electronic component marketplace as of January 2019.

Report highlights

- Multi layer ceramic capacitors (MLCC’s) are still the most problematic components within the marketplace. Most MLCC manufacturers are still quoting excessive lead-times, or in some cases allocation. The stock that is becoming available is subject to significant price increases with the inability to schedule purchase orders.

- MLCC shortages have now been commonplace for over a year and it is not certain if any improvement in the market will be seen until 2020.

- After more than two years of pricing uncertainty and allocation it appears the memory market is slowly starting to recover, with price decreases seen on some NAND and DRAM products.

Capacity and Lead-Time Issues

- Infineon have issued an End Of Life (EOL) notice for small signal products with a Last Time Buy (LTB) of the 31st December 2019.

- Nexperia are still struggling with allocation on some product lines, most notably diodes and mosfets in cases sizes SOD323, SOT223, SOT23 and SOT232; this issue is still ongoing

- Rohm are also struggling to meet demand with extended lead-times continuing and allocation confirmed on EMD2, EMD2M, PMDU, PMDUM, TUSH, TUMD2S, UMD2M and USM products until further notice.

- Xilinx lead-times are also extending making it vital for original equipment manufacturers to share their long term forecast information with their supply chain partners in order to help maintain continuity of supply.

- NXP have placed a 15%+ price increase on some of the former 32bit Freescale processors, however lead-times appear stable.

- It is reported that some manufacturers have increased MLCC pricing by up to 40% compared to 6 months ago

Pricing Uncertainty

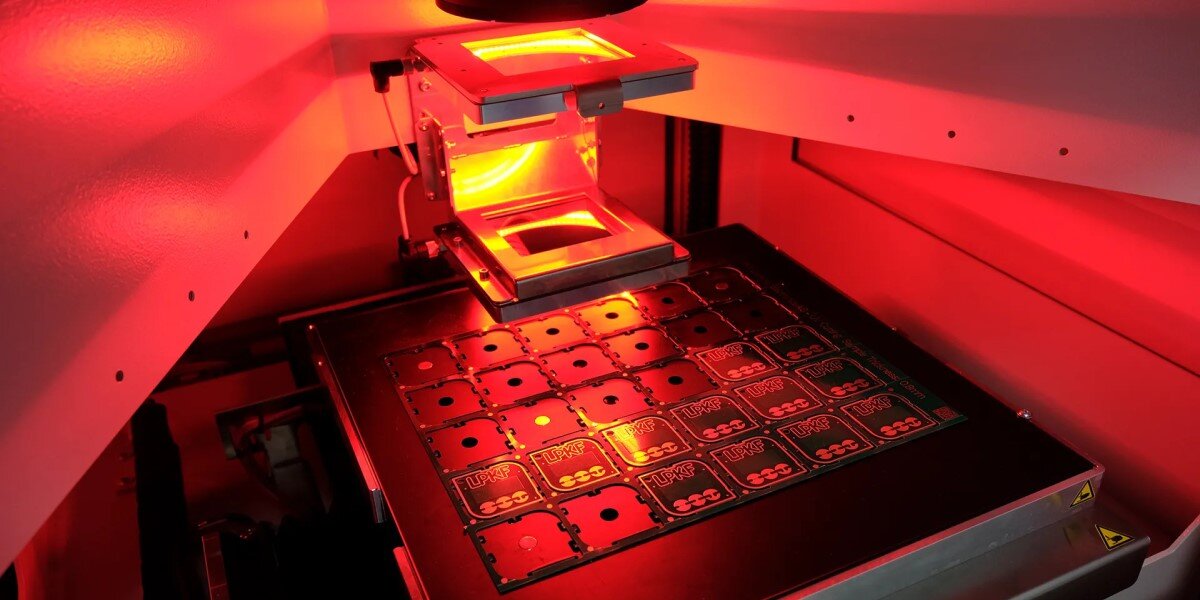

PCB technology

- The annual Chinese New Year celebrations will see factories close between around 31st January 2019 and 10th February 2019. Disruption to lead-times should be expected for a couple of weeks either side of these dates.

- Copper pricing started to fall at the start of December, but is now slowly climbing with pricing now more in-line with the historic prices we saw back in August 2018.

- Some PCB suppliers have already carried out a risk analysis for Brexit strategies, and have put stock in place, with facilities to hold bare PCB’s should there be the expected customs delays when importing to the UK.

Global Economy

- CIPS (Chartered Institute of Procurement and Supply) Brexit surveys suggest that 70% of UK Manufacturing companies said that currency fluctuations made their supply chain more expensive.

- CIPS found that 20% of manufacturing companies would look to ‘re-shore’ supply chains to the UK amid Brexit uncertainty.

- Gold is trading at £1024.27 per ounce, climbing since the lows seen in September 2018 of nearer £900.00 per ounce

- Silver prices are also rising with January 2019 reporting pricing of £12.35 per ounce against a low of £10.75 observed in September 2018.

- Oil pricing was at a twelve month low in late December 2018 at $50.47 per barrel with the highest price seen in October 2018 of $84.16 per barrel.

- Stainless steel pricing in China has remained flat with low demand in the run up to Chinese New Year and as a result suppliers are keeping their stock levels low.

- The EU will vote on 16th January 2019 regarding a cap on steel imports in wake of President Trump putting tariffs on steel and aluminium imported in to the United States. If passed, this vote would put a cap on imports for three years into the EU.

- A number of companies are now holding inventory off shore as supply chains are attempting to mitigate against the risk of Brexit and are taking advice from industry and logistics experts on border controls and trade agreements.